The cents per kilometre method is often misunderstood when it comes to claiming car expenses. This article is a comprehensive guide for claiming all things related to the cents per km method.

Whether you’re a business owner, a self-employed professional, or an employee looking to optimise your tax deductions, this article will equip you with the knowledge and confidence to make the most of this often-underutilised method, ultimately allowing you to maximise your savings while ensuring compliance with tax regulations. For comprehensive financial planning advice tailored to your situation, professional guidance can help optimise all aspects of your finances.”

How does Claiming Car Expenses work?

In Australia, claiming car expenses can be done through two primary methods: the cents per kilometre method and the logbook method.

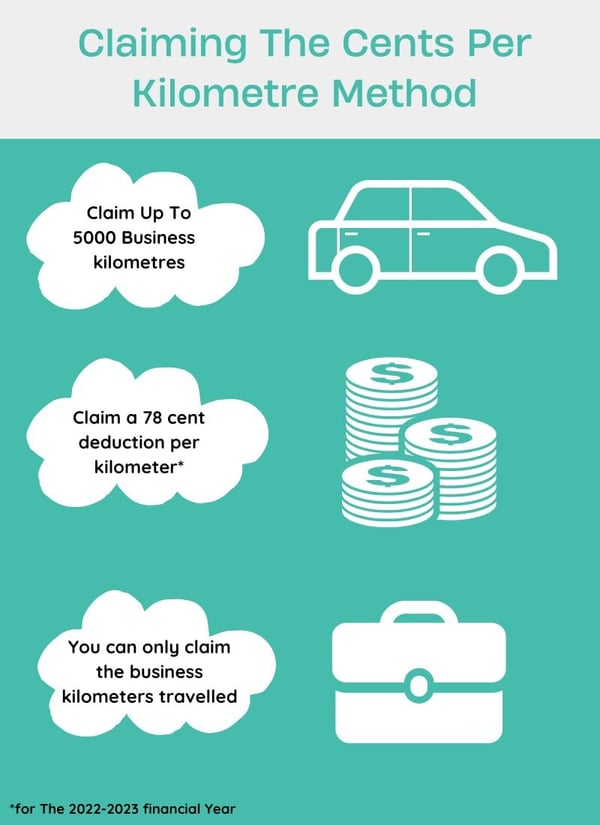

The cents per kilometre method allows taxpayers to claim a fixed rate per business-related kilometre travelled in their personal vehicle, up to an ATO km allowance of 5000 kilometres. This is sometimes called the ATO 5000 km rule.

This method eliminates the need for detailed record-keeping, making it convenient for individuals who find tracking every expense challenging.

On the other hand, the logbook method requires maintaining a logbook for a minimum continuous 12-week period to determine the business use percentage of the vehicle. This percentage can then be applied for 5 years. This method offers more flexibility as it allows taxpayers to claim the actual expenses incurred, such as fuel, rego, repairs, capital costs and maintenance, proportional to the business use percentage, it is often called the actual costs method.

Both methods have their advantages and considerations, in this article we will do an in-depth discussion of the cents per kilometre method.

How Much Can You Claim in 2025?

When it comes to work-related travel, every kilometre counts—and the good news is you can claim them to maximise your tax return.

In the 2024–25 financial year, you can claim up to 5,000 work-related kilometres using the cents per kilometre method, without needing to provide written evidence (just a reasonable calculation or diary).

The cents per kilometre rate for 2024–25 has increased to 88 cents per kilometre, reflecting rising fuel and vehicle costs.

This updated rate acknowledges the everyday expenses faced by professionals like you and helps ensure you’re fairly reimbursed for the work-related travel you do.

So, buckle up, track your work kilometres carefully, and claim what you’re entitled to—those savings add up fast!

Conditions for Claiming Work Related Car Expenses

Before you get ahead of yourself their are certain criteria that must be followed when claiming work-related car expenses.

Navigating the world of car expense claims can be tricky, and there are a few important considerations to keep in mind. Firstly, if you’re receiving reimbursements for your work-related travel expenses or if you have a company car at your disposal, you generally won’t be able to claim additional expenses.

Additionally, if you have a novated lease arrangement in place, where your employer leases a vehicle that you use, you are unable to claim any car expense methods, as the lease will be deducted from your taxable income.

When it comes to reimbursements from your employer, you are unable to claim these expenses. The reason behind this is that reimbursements for car expenses received from your employer are considered as non-taxable income.

You Need Proof

Accurate records serve as essential proof to the Australian Taxation Office (ATO) when claiming motor vehicle expenses using the cents per kilometre method, ensuring a seamless and successful claim process.

Whether it’s keeping a detailed diary of the distance travelled, utilising specialised apps, or maintaining an organised spreadsheet, documenting your business-related kilometres is essential. The ATO may request these records as proof of your claims, so it’s important to have reliable evidence.

When it comes to claiming the cents per km method, the Australian Taxation Office (ATO) has a clear definition of what qualifies as a car. According to their guidelines, a car is classified as a vehicle that can carry a load of less than 1 tonne and accommodate fewer than 9 passengers.

It’s important to note that motorcycles, trucks, minibuses, and certain utes do not fall under the category of cars as defined by the ATO. So, if you’re looking to claim those sweet deductions, make sure you’re cruising in a vehicle that meets the ATO’s definition of a car.

It’s also worth noting that you must have proof of car ownership or leasing to make any claims. So, stay organised, keep track of your kms, and gather the necessary documentation to maximise your car expense claims effectively.

What Kilometres Count?

Many individuals get confused and believe they can claim all the distance travelled in their car during a year. You are only allowed to claim the business kilometres as a tax deduction, not all travel when you claim car expenses.

Curious about what qualifies as work-related travel? While you can’t claim the distance to and from your regular workplace (bummer, right?), there are still some thrilling opportunities to save on your taxes.

The ATO allows you to claim the cents per km method for business purposes if you’re travelling between different jobs in a day. Oh, and here’s a twist: if your home serves as a base of employment, you can even deduct the distance from there to your job.

If you have more than one car you can claim the cents per km method on your income tax return. The ATO doesn’t have a person limit, instead a vehicle limit on the KMs, so if you have two vehicles you could claim up to 10,000km on work-related trips. It is important to remember the previous rules and to ensure you have records to back up your claims.

What are some Additional Claims?

It’s a common misconception that claiming the cents per kilometre method for work-related car expenses opens the door to additional deductions. However, it’s important to clarify that the method encompasses all car-related expenses, including fuel costs, maintenance, insurance, registration, decline in value, and repairs.

In other words, you can’t pile on extra deductions for specific car expenses on top of what’s already covered by the method. So, while this method offers a convenient way to claim your car expenses, it’s essential to understand the limitations and avoid trying to double-dip on your income tax return.

The logbook method may be a better option if you have higher running costs and larger work-related expenses, but either way the extra tax you save is most powerful when it’s part of a bigger picture reviewed by a retirement planning advisor.

If you are looking to save – you should consult a financial planner.

Next Steps

This comprehensive guide has shed light on important factors such as eligibility criteria, proof requirements, and what qualifies as work-related travel. While the method covers various car expenses, it’s essential to note that you cannot claim additional deductions beyond what is already included.

For individuals with significant running costs and larger work-related expenses, the logbook method may be a more suitable option. Contact one of our central coast accountants so they can help you understand the best option for your circumstances.