Perfect Foundations

Are you looking to buy your first home or have recently purchased your first home?

When embarking on your journey through life, the task of managing your finances can seem daunting. You might receive advice on the importance of budgeting, consolidating your superannuation accounts, maintaining records for taxes, and securing various insurance policies. This plethora of information can quickly become overwhelming, leading many to procrastinate and push financial matters aside. Yet, with the proper support system and a solid structure in place, you can gain the confidence to seize control of your finances and steer them toward your life’s aspirations.

Certain life goals, such as owning a home, realising your picture-perfect wedding, or affording your dream car, may seem out of reach unless you receive a significant financial gift from your family, a luxury that most Australians can’t rely on. Nevertheless, by creating a financial plan and implementing strategies like the first home super saver scheme, you can significantly reduce the time needed to save a deposit to buy your first home and reach your life’s goals.

The Importance of Foundaitons

By becoming financially organised early in life, you will be laying the foundations for a prosperous future, positioning you ahead of the curve by harnessing the power of compound interest. Implementing an investment plan in your youth and ensuring proper allocation of your superannuation funds could translate into a substantial difference, potentially amounting to hundreds of thousands of dollars extra in retirement. Time is your greatest ally when you’re young, and when coupled with diversified investments that are leveraging compounding interest, it becomes a formidable asset.

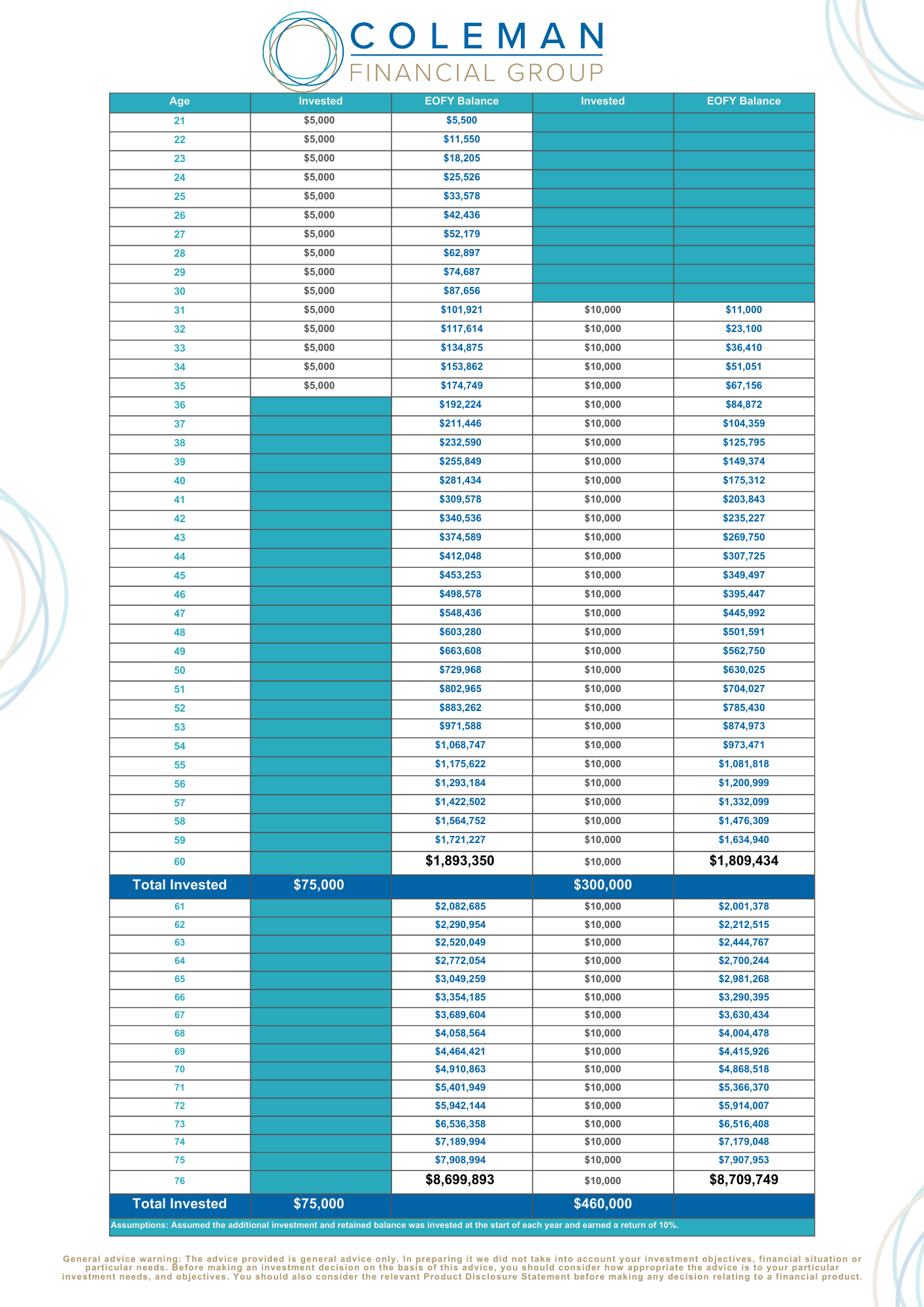

Below is an illustration of two individuals who initiated an investment plan. One began investing with a smaller balance at an earlier stage in life, while the other allocated a larger sum to the plan but commenced ten years later. Despite investing for twice as long as the first individual and allocating four times the amount, the person who started ten years later still ended up with a smaller balance by the age of 60. For those interested, in this scenario, the second individual wouldn’t surpass the first individual’s balance until reaching the age of 76, with an additional investment of $160,000.

Other Ways We Can Help

Pathway to Wealth

Countdown to Retirement

Approaching retirement can bring uncertainty, but it’s never too late to take control of your financial future. You might be wondering, ‘When can I retire?’ Hiring an expert retirement financial advisor provides you with the clarity you need to answer that question confidently. We’ll help you understand when retirement is realistic for you, what kind of lifestyle you can enjoy, and how to grow your wealth to ensure a secure and comfortable future.

Retire in Style

Retirement is a major milestone, marking the beginning of a well-deserved chapter in your life. As you celebrate this transition, our top priority is to help you make the most of your retirement. We’ll guide you through the complex Centrelink advice, taxation and superannuation regulations, ensuring you maximise your benefits and enjoy the retirement you’ve worked so hard for. Let us help you navigate these challenges so you can focus on enjoying this exciting new stage of life.

General Advice Warning: The information contained on this website has been provided as general advice only. The contents have been prepared without taking account of your objectives, financial situation or needs. You should, before you make any decision regarding any information, strategies or products mentioned on this website, consult your own financial advisor to consider whether that is appropriate having regard to your own objectives, financial situation and needs.

Disclaimer: Whilst Coleman Wealth Pty Ltd is of the view the contents of this website are based on information that is believed to be reliable, its accuracy and completeness are not guaranteed and no warranty of accuracy or reliability is given or implied and no responsibility for any loss or damage arising in any way for any representation, act or omission is accepted by Coleman Wealth Pty Ltd or GPS Wealth Ltd or any officer, agent or employee of Coleman Wealth Pty Ltd or GPS Wealth Ltd.

Sharon Goodwin is an Authorised Representative of GPS Wealth Ltd AFSL 254 544, Sharon Goodwin is a Sub-Authorised Representative of Coleman Wealth Pty Ltd ABN 93 670 350 071, a Corporate Authorised Representative (455141) of GPS Wealth Ltd ABN 17 005 482 726

Licensee contacts

T: 02 8074 8599

A: Level 11, 45 Clarence Street Sydney NSW 2000